Why Commercial Multifamily Real Estate?

The latest listing of Forbes show that:

77% of all millionaire investors own real estate while 90% of the Forbes 400 of wealthiest individuals either made or retain their wealth in real estate.

In fact, in the summer of 2012, J.P. Morgan went so far as to suggest that real estate investing should no longer be considered an alternative investment.2 To quote them, “the reality is that investment portfolios focused on the ‘Big Two Traditionals,’ bonds and equities, are forcing investors to compromise – either by sacrificing return for lower volatility or enhancing return at the expense of higher risk.”

The report continued, “Real estate may offer a way out. This is why we believe real estate is increasingly being viewed, not as an alternative, but as an essential portfolio component.”

During my own transition into commercial real estate investing and subsequently as an investor in several commercial multifamily projects, I have come to understand the long-term benefits of this asset class. There are downsides of course, just as there are in any investment. However, for me commercial multifamily is an important part of my long-term strategy.

Of course all investments have risk, however, many investors find multifamily real estate to have several attractive benefits:

- Principal Protection / Compelling Risk-Adjusted Performance

- May Provide Current Income

- Principal Pay Down

- Appreciation

- Several Tax Benefits

- Inflation Protection

- Evergreen Business Model

- Asset Protection and Leverage

- Economic Cycle Protection

- Diversification

- Large Investable Universe

Now let’s go over each one in more detail.

Principal protection

Multifamily investments have the best risk-adjusted return (Sharpe ratio) of any real estate asset class and have one of the lowest failure rates of any real estate investment. In fact, it is such a stable asset class that it is a significant portion of almost every AAA rated insurance company.

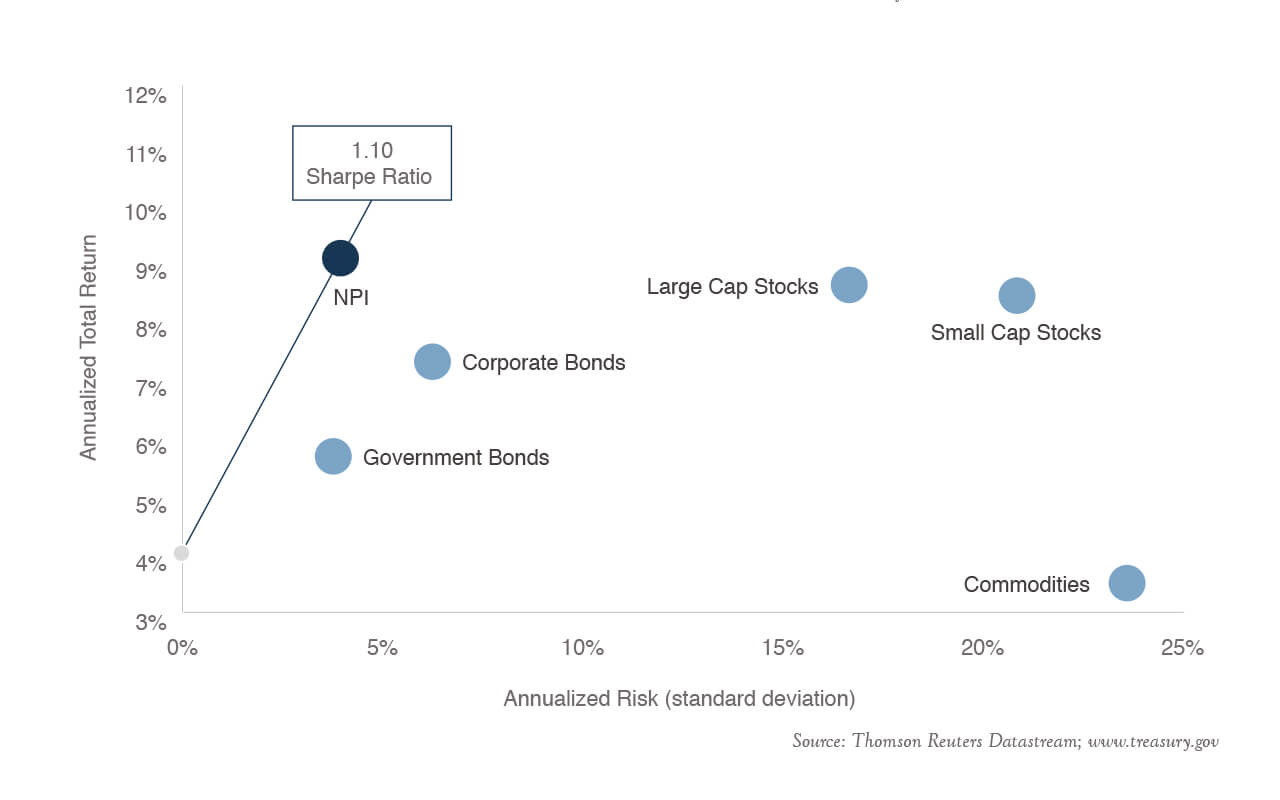

Figure 1 shows the risk-adjusted return (Sharpe ratio) for all of the major asset classes. Keep in mind that the higher the Sharpe ratio, the better the return per unit of risk.

Core commercial real estate has the best Sharpe ratio of any other asset class. Let me point out that this graph shows all commercial real estate asset classes (NPI). If you just looked at multifamily by itself, the risk adjusted return would be higher meaning that the returns would be better with less risk.

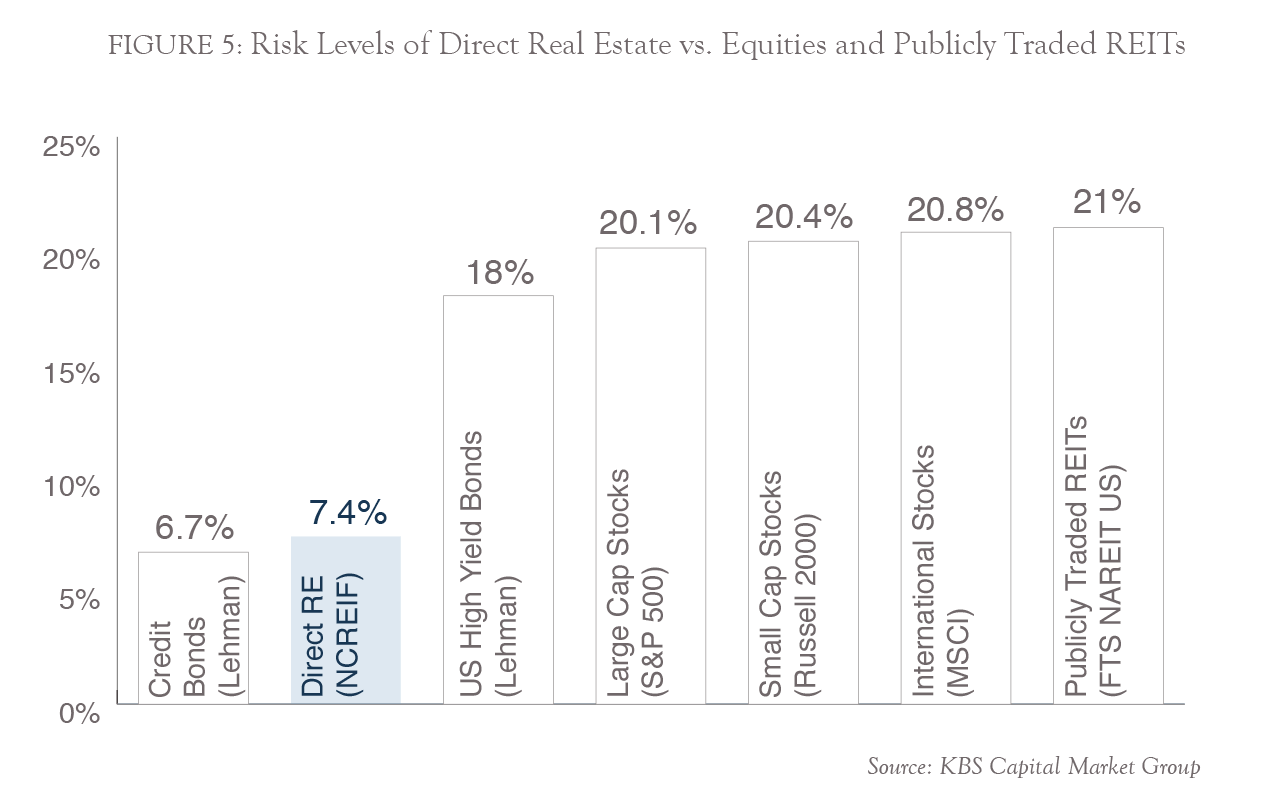

Consequently, over the last 20 years, direct ownership of commercial multifamily real estate has had the best risk adjusted returns of any other real estate asset class, the stock market, bonds, and REITs. In fact, those returns were three to four times less risky than REITs as well as large and small cap stocks.

One of the reasons multifamily has a good safety profile is that it represents an investment in the basic need of shelter.

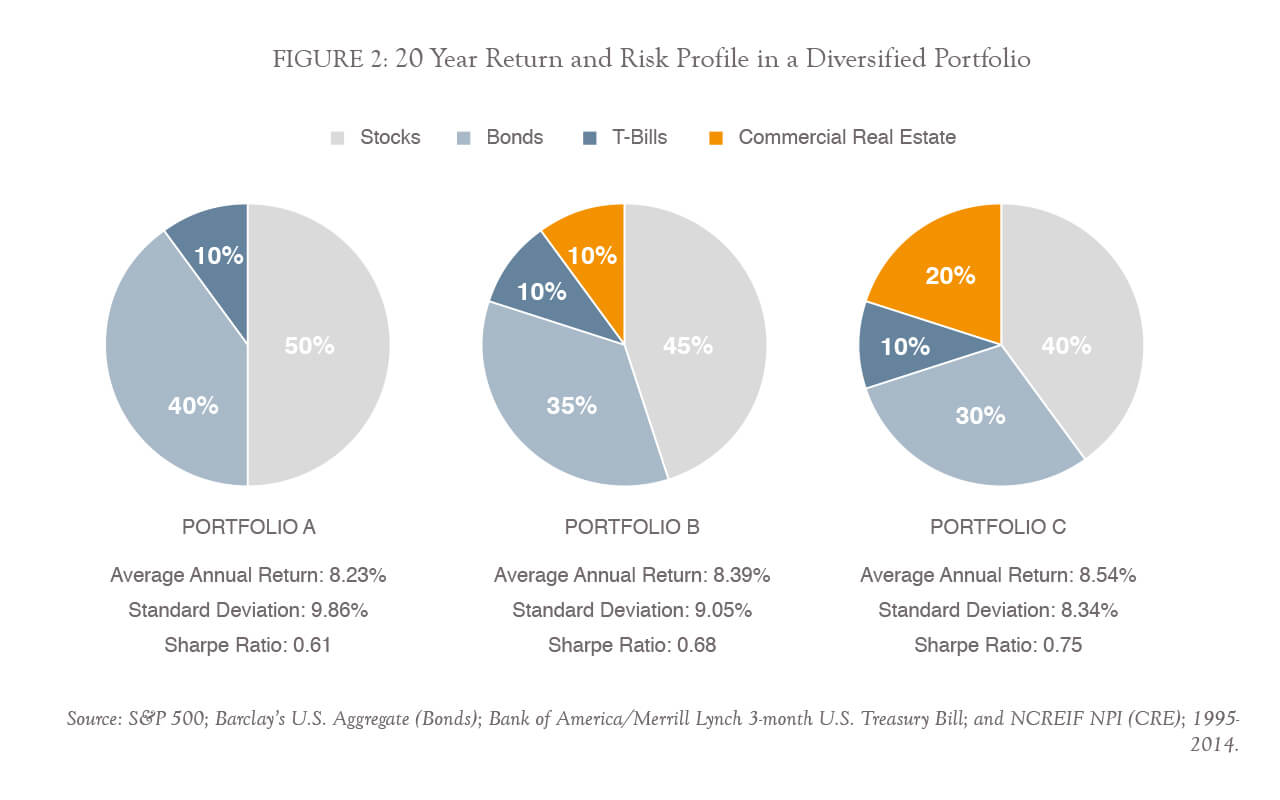

Figure 2 shows what could happen to people’s portfolios when they diversify into commercial real estate. By selling off 5% of their stocks and 5% of their bonds and investing that 10% in direct ownership of real estate, they realize better returns with less risk. Increasing that allocation to 20% in direct real estate further increases returns while decreasing risk. In that way, diversification into direct real estate has a stabilizing effect on stock/bond portfolios by enhancing returns while decreasing risk.

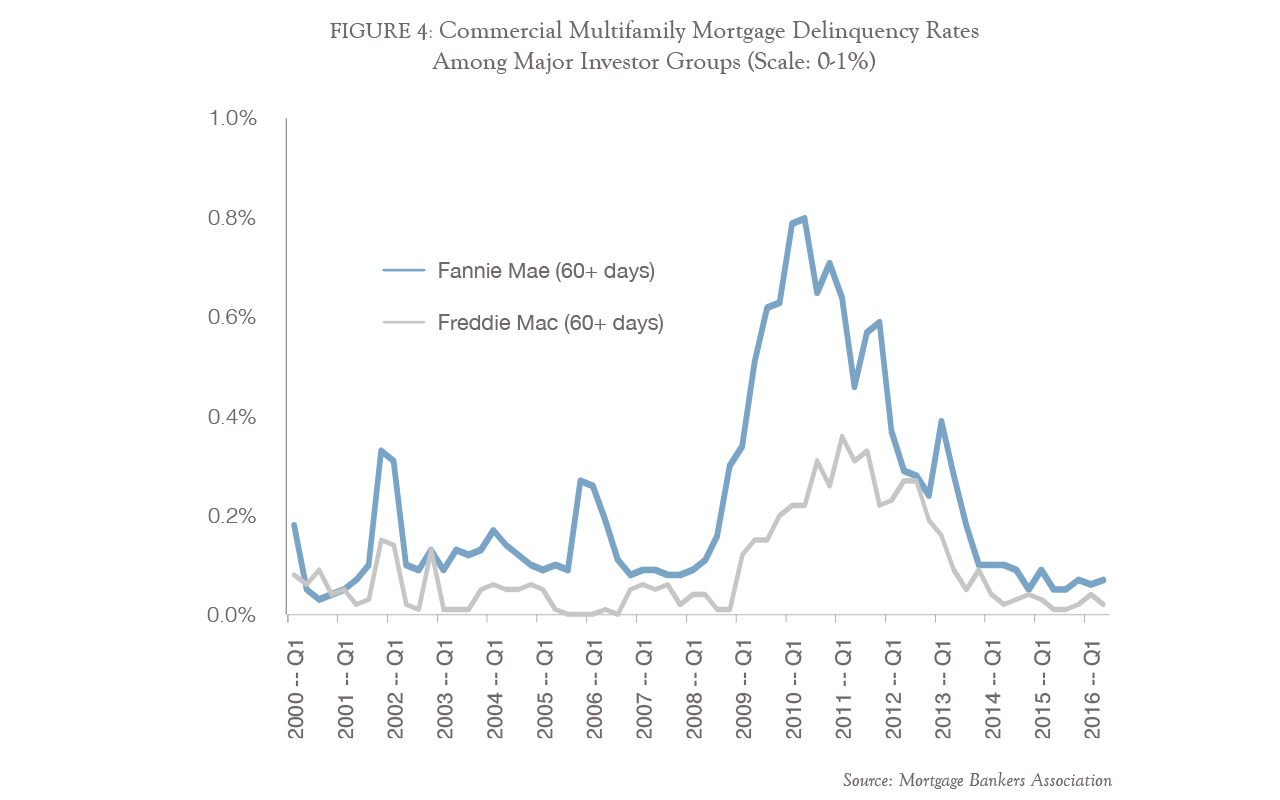

In addition to having the best long-term risk adjusted return (Sharpe ratio), commercial multifamily real estate that conforms to strict underwriting standards has incredibly low foreclosure rates.5 We can extrapolate the foreclosure rate from the 60-day delinquency rate, but it is so low (barely visible in Figure 3) that we have to change the scale to magnify the data for you to see it (Figure 4).

For those of you who have read Thomas Stanley’s book The Millionaire Next Door, you know the research. The vast majority of millionaires made their first million through owning their own business or investing in real estate. When you consider that 80% of all new businesses fail within five years and 96% fail by year ten,it seems obvious that the better choice is multifamily real estate and its sub 1% long-term historical failure (foreclosure) rate.

Another way to measure risk is in terms of volatility. Historically, real estate has had significantly lower volatility than other asset classes. Volatility is one of the reasons I stopped investing in the stock market. While that decision may not be right for you, diversification into this stable, low-volatility asset class can strengthen many portfolios.

Next, and very important to me personally, is current income (i.e., cash-flow). This is monthly, quarterly, or annual cash in your pocket after expenses have been paid. Cash flow is the income left over after subtracting operating expenses and any mortgage payments from gross operating income (collected rent). When there is net distributable income it becomes yield for the investor.

The yield from my real estate is an integral part of my financial plan. At first I used it to cut back to part-time work, but eventually built it up to the point in which I retired from medicine at the age of 45. I am fortunate to be a full-time dad that is actively engaged in my children’s lives. Building a retirement income that I cannot outlive was the key.

Commercial multifamily real estate will allow me to retire much earlier than my colleagues and live off of the cash-flow without having to touch the equity that I have built up.

* The author’s experience may not be indicative of the experience of others attempting the same investment strategy.

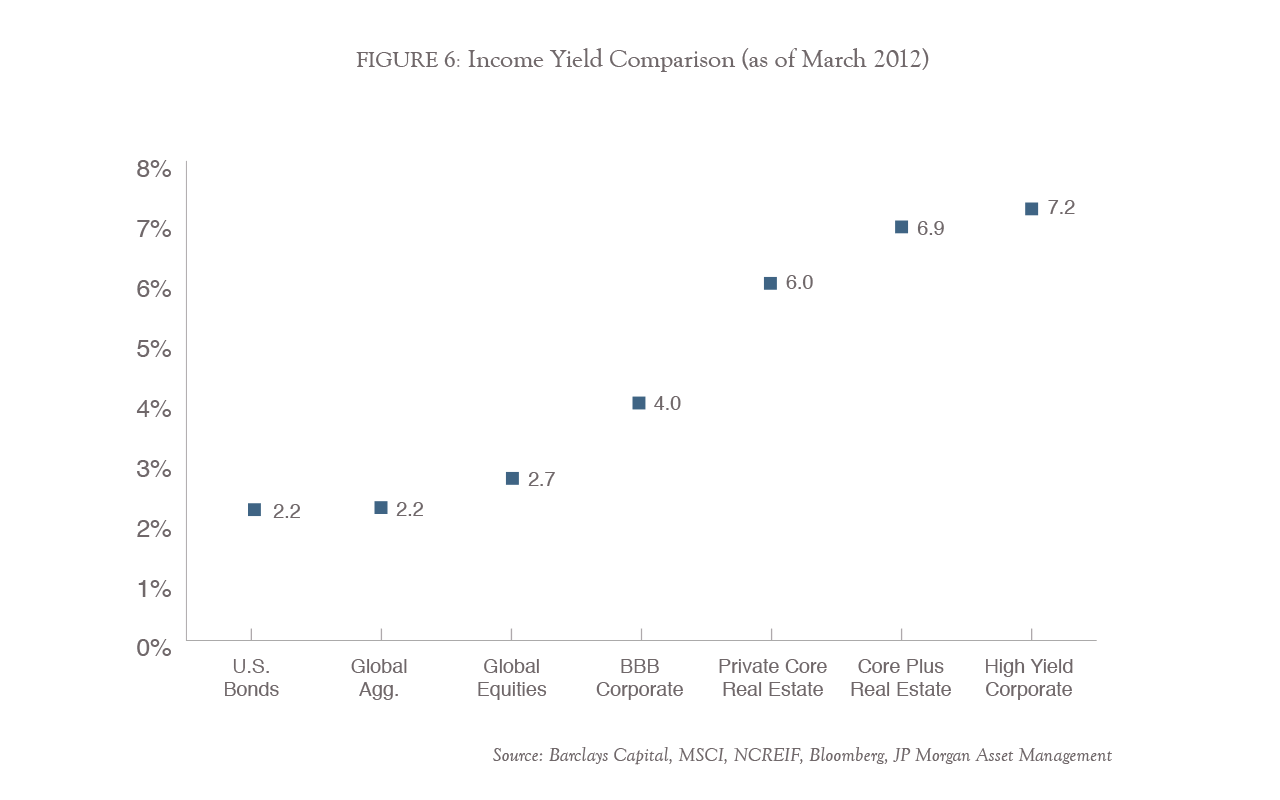

Certainly, other investments like bonds and dividend stocks may provide the investor with some yield. However, as Figure 6 shows, that yield tends to be too low for my needs. It is quite rare to find yields as attractive as you can obtain with real estate without having to take on significantly higher risk.

Principal pay down is considered by many to be the safest of all wealth creation tools. When the residents pay their rent, they are paying down your mortgage. At the end of every year, your equity grows regardless of rent growth, market conditions, etc. Of course, you need to use leverage on the property to get this benefit, but conservative 60% to 75% LTV loans with attractive interest rates, make this a nice benefit.

Appreciation is another way that the real estate investor grows his or her equity. Residential real estate (1-4 units) is primarily valued by the comparison or “comp” method of appraisal. In this method, the appraiser searches for recently sold properties of similar size, with similar amenities, and in close proximity to the subject property. By comparing the sales prices of those properties with the subject property, the appraiser can determine a value. Unfortunately, this model gives the investor little to no ability to affect the value of the property.

By comparison, commercial real estate valuation is determined by the money it brings in. With these properties, net operating income (NOI) largely determines the value of the property. NOI is simply the net between gross income and all expenses (with the exception of debt service). If NOI goes up then the property appreciates in value.

Unlike residential real estate, commercial real estate gives the investor the opportunity to influence appreciation.

To better understand this concept, let’s look at the components of NOI. As previously stated, NOI is gross operating income minus operating expenses.

Consequently, the owner of investment real estate can raise the value of his or her property by increasing income (raising rents, creating new income sources, or increasing retention) or by decreasing expenses. Successful commercial real estate investors do an excellent job growing NOI to drive the appreciation of their properties.

While optimizing NOI helps your cash flow, its biggest advantage can be seen in appreciation. To better understand how optimizing NOI drives up the value of your property, let’s review commercial real estate valuation. The formula for calculating the value of commercial real estate is as follows:

Property Value = NOI / Capitalization Rate (Cap Rate)

In the simplest of terms, the capitalization rate is the rate of return an investor would expect to receive if he or she paid all cash for the property. Given this definition, the higher the cap rate is the better it is for the buyer. Conversely, lower cap rates benefit the seller. Cap rates are market specific. The cap rate for an apartment building will be different in San Francisco than it will be in Dallas.

By rearranging the above formula, the cap rate is calculated as follows:

Cap Rate = NOI / Value

To better illustrate how commercial real estate is valued based on this income approach, let’s take a look at an example.

In this example, we will look at a property in an 8% Cap Rate market that increases its annual net operating income from $200,000 a year to $300,000.

Value = $200,000 / 0.08 = $2,500,000

Value = $300,000 / 0.08 = $3,750,000

By raising rents, decreasing expenses and increasing renter retention the astute property owner can maximize net operating income. As you can see, doing so can be quite lucrative in the form of appreciation.

As easy as this may look on paper, the truth is that whether your property appreciates in value and how quickly it does so is determined by a confluence of circumstances. These circumstances include buying the right property in the right market and using the right management strategies.

As I’ve said previously, having or hiring the right knowledge and skill is critical in successful real estate investing. Keep in mind that the above formula works in the opposite direction and can lead to loss of value as well.

Another often overlooked but material financial benefit of real estate investing is the tax benefit. The two biggest drags on your wealth are taxes and inflation.

Next Steps

To learn more about how you can benefit from this asset class, schedule a 15-minute phone consultation today.

Don’t hesitate as the consultation is complimentary and there is No Cost and No Obligation to you. We welcome the opportunity to assist you in reaching your financial goals.

References & Sources

- WikiBooks. Real Estate Financing and Investing/Sources of Funds.

https://en.wikibooks.org/wiki/Real_Estate_Financing_and_Investing/Sources_of_Funds - J.P. Morgan Asset Management. Real Estate: Alternative No More. July 2012.

https://am.jpmorgan.com/blobcontent/131/169/1383169203231_11_559.pdf - The Street. Real Estate: Best-Performing Asset Class During the Past 20 Years. October 2016.

https://www.thestreet.com/story/13861401/1/real-estate-best-performing-asset-class-during-the-past-20-years.html - MetLife Investment Management. US Core Real Estate: A Past, Present, and Future View. 2017.

https://www.metlife.com/assets/cao/investments/US-Core-Real-Estate-Par-Present-Future-View.pdf - Mortgage Bankers Association. Commercial/Multifamily Mortgage Delinquency Rates for Major Investor Groups. Q2 2016.

https://www.mba.org/Documents/Research/2Q16CMFDelinquency.pdf - Forbes. Five Reasons 8 Out Of 10 Businesses Fail. September 2013.

http://www.forbes.com/sites/ericwagner/2013/09/12/five-reasons-8-out-of-10-businesses-fail/#605955d55e3c - Inc. Why 96 Percent of Businesses Fail Within 10 Years. August 2015.

http://www.inc.com/bill-carmody/why-96-of-businesses-fail-within-10-years.html - Business Insider. Millennials Are Getting Stuck Renting For Way Longer Than Previous Generations. August 2015.

http://www.businessinsider.com/millennials-renting-for-very-long-time-2015-8 - CNBC. Millennials will be renting for a lot longer. September 2016.

http://www.cnbc.com/2016/09/09/millennials-will-be-renting-for-a-lot-longer.html - National Multifamily Housing Council. Apartment Supply Shortage Fact Sheet.

https://www.nmhc.org/Advocacy/Apartment-Supply-Shortage-Fact-Sheet/ - Bloomberg. Student Debt Is Stifling Home Sales. February 2012.

https://www.bloomberg.com/news/articles/2012-02-23/student-debt-is-stifling-home-sales - Freddie Mac. Multifamily Research Perspectives. 2015 Multifamily Outlook Executive Summary.

http://www.freddiemac.com/multifamily/pdf/2015_outlook.pdf