The When of Multifamily

Real Estate Investing

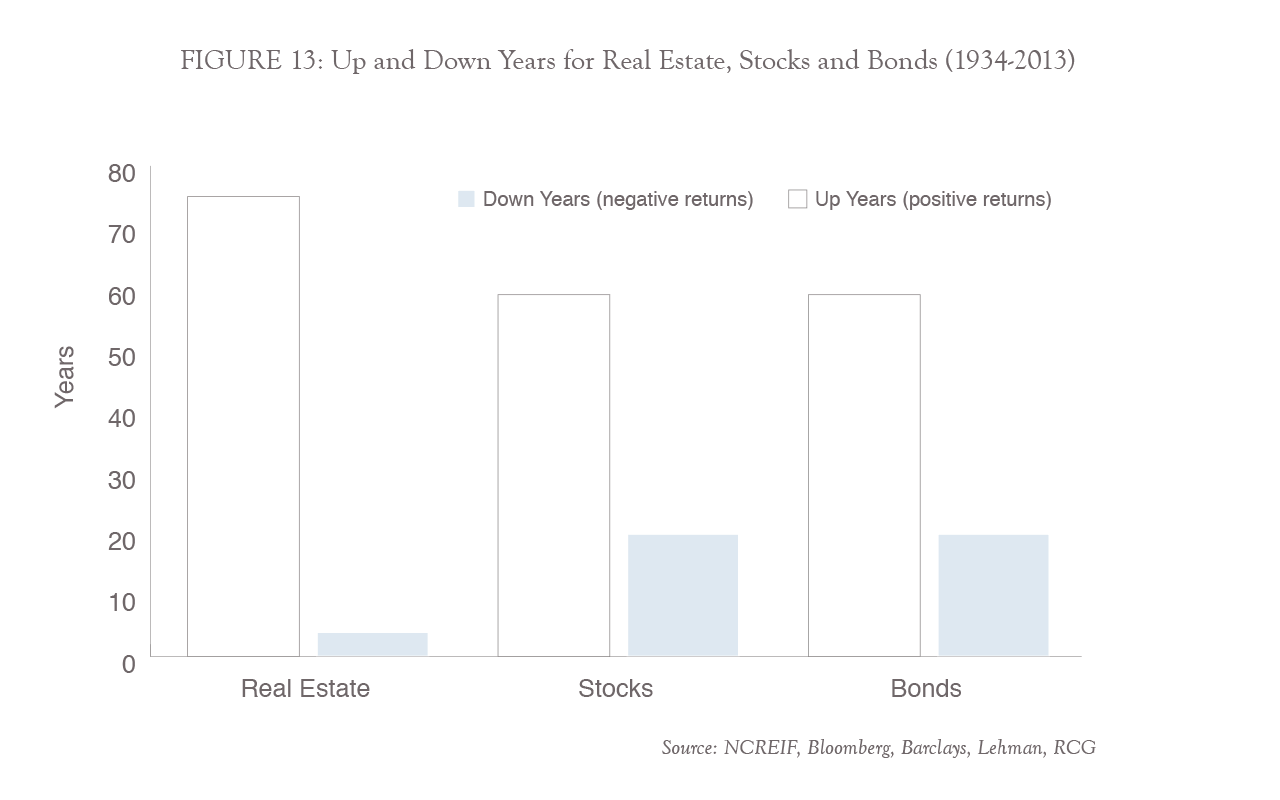

As Figure 13 shows, real estate has a strong historical track record for having far more up years than down years and providing investors with quality returns. A big part of that historical track record is the strength of multifamily.

However, there are three factors that have aligned that could potentially make this the best time ever to invest and will likely carry this trend forward for years to come. In fact, many feel these trends will continue for decades. Let me explain.

The information I am about to present should make each and every one of you stand-up and take notice. This is the reason why I say that everyone should consider having some commercial multifamily real estate in their portfolio. In essence, it is a trifecta of simultaneous windfalls that are driving this space now and well into the future.

- Population Dynamics / Increased Demand

- - Baby Boomers

- - Echo Boomers

- - Immigration

- Constrained Supply

- Trend away from home ownership

- Legacy wealth transfers on a stepped up basis

Population Dynamics

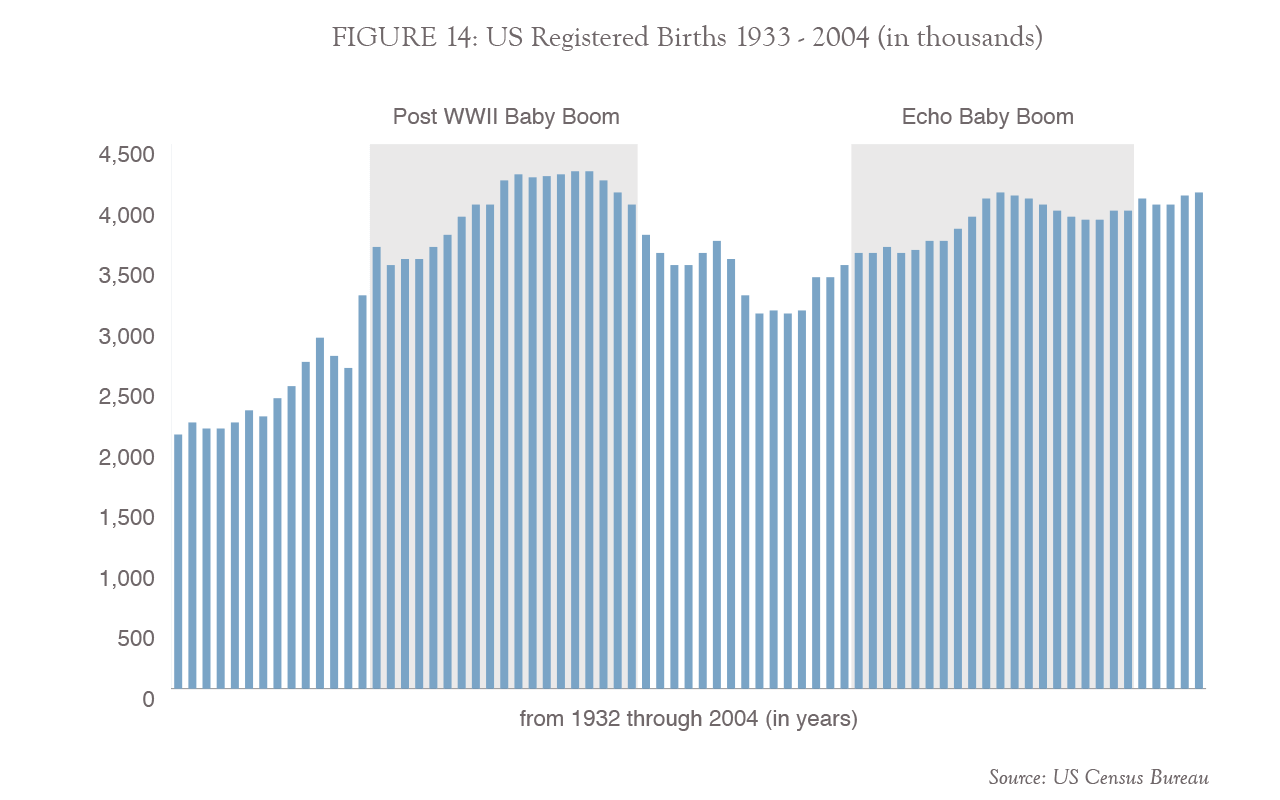

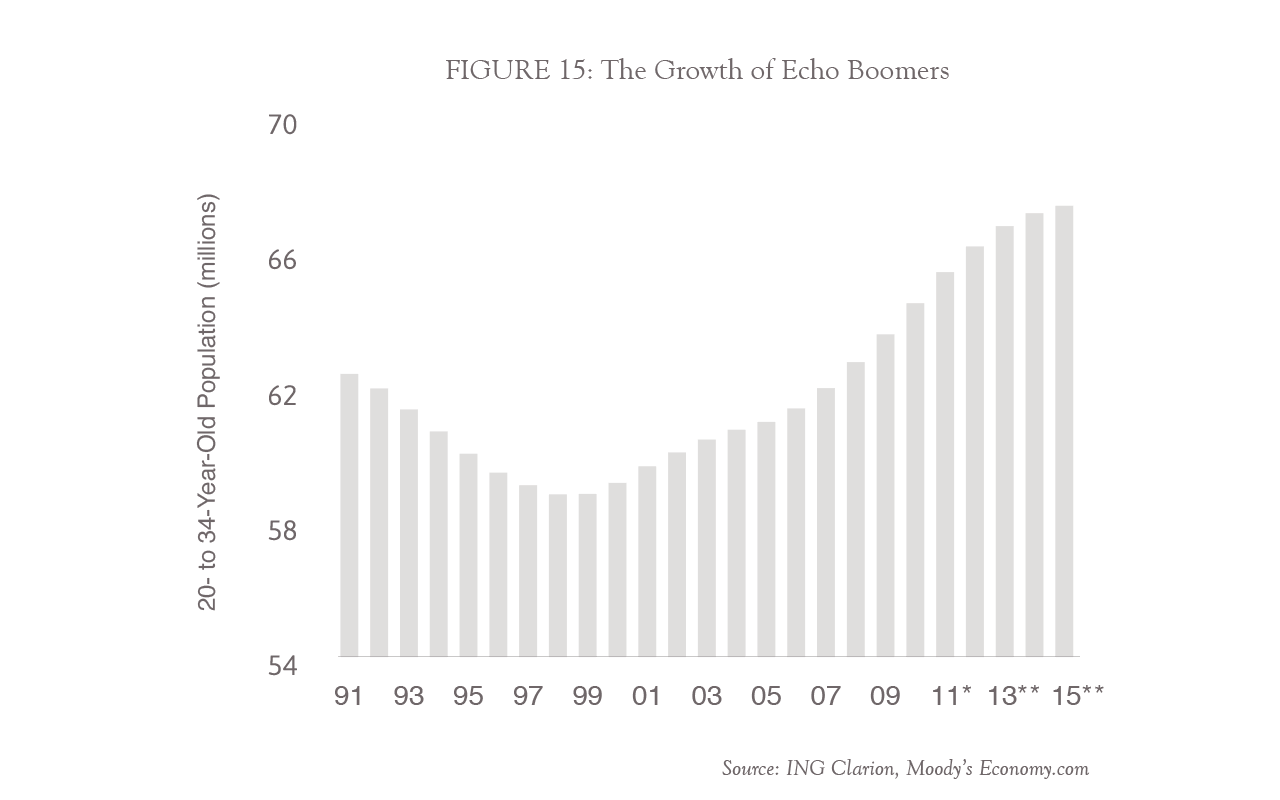

As of this writing, the US population is just under 318,000,000 people. About half of those people are either Baby Boomers (born between 1946 and 1964) or Echo Boomers (born in the early 1980’s to 2000). The Echo Boomers are also referred to as Millennials or Generation Y. Figure 14 shows just how massive these two groups are. Why is this fact important? The largest renter cohort in the US are those age 18-34, while the fastest growing cohort are those over 55. It just so happens that the Echo Boomers and the Baby Boomers coincide with those age groups.

For those over 55, it is true that once they downsize and start renting, they tend to remain renters for the rest of their lives. Studies also show that seniors continue to enjoy longer and healthier life spans. As for the Millennials, they represent a large population wave of people who rent much more frequently than any other age group and stay in apartments longer than em.

As if the demographic story favoring renters wasn’t compelling enough, Generation Z (the generation following the Millennials) is the biggest cohort this country has ever produced. When they come of age and start renting, the wave of demand we are currently seeing could very likely become a tidal wave.

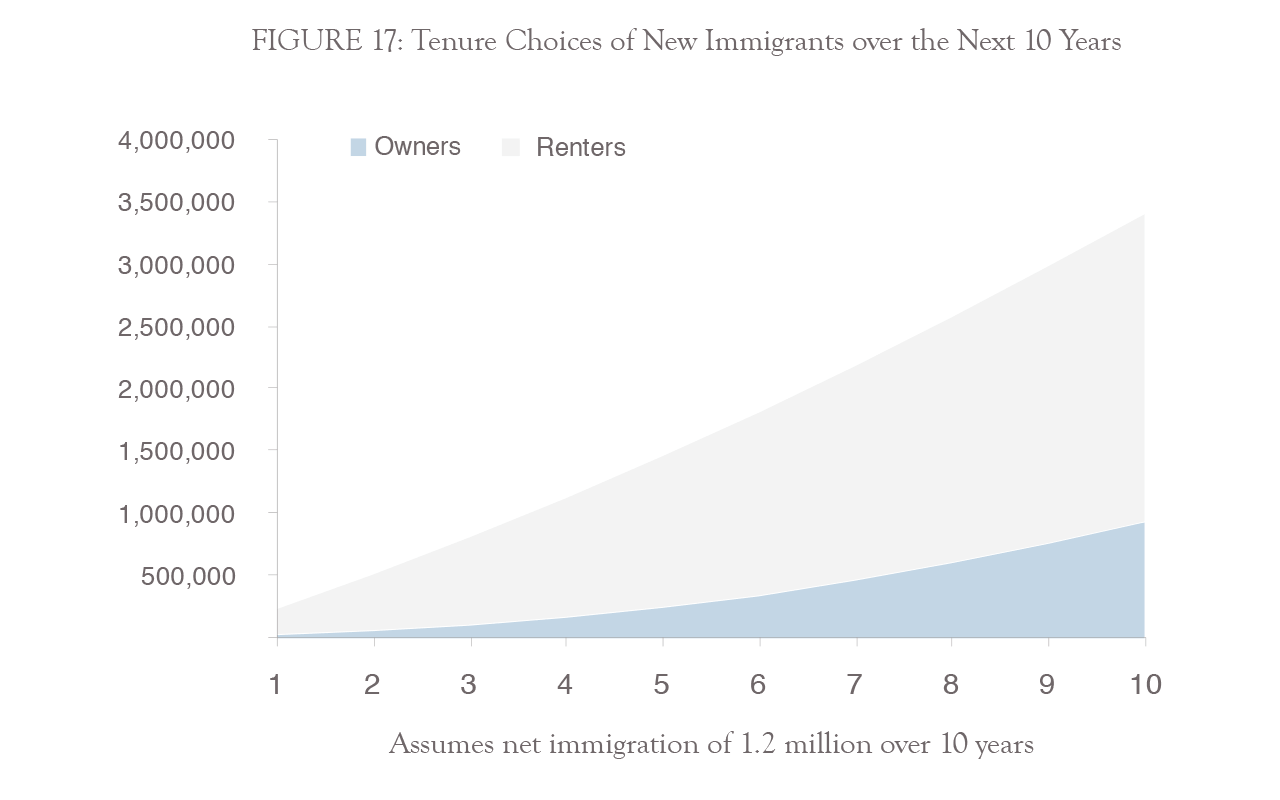

Regardless of the various political views on immigration, immigrants represent a massive pool of people who rent much more commonly than they own. In fact, the US Census Bureau estimates that there is one new immigrant in this country every 40 seconds. Immigrants are also more likely to be life-long renters and never own a house of their own. The National Association of Home Builders studied the preferences of living situations amongst immigrants to this country. Figure 17 is from their 2012 report.

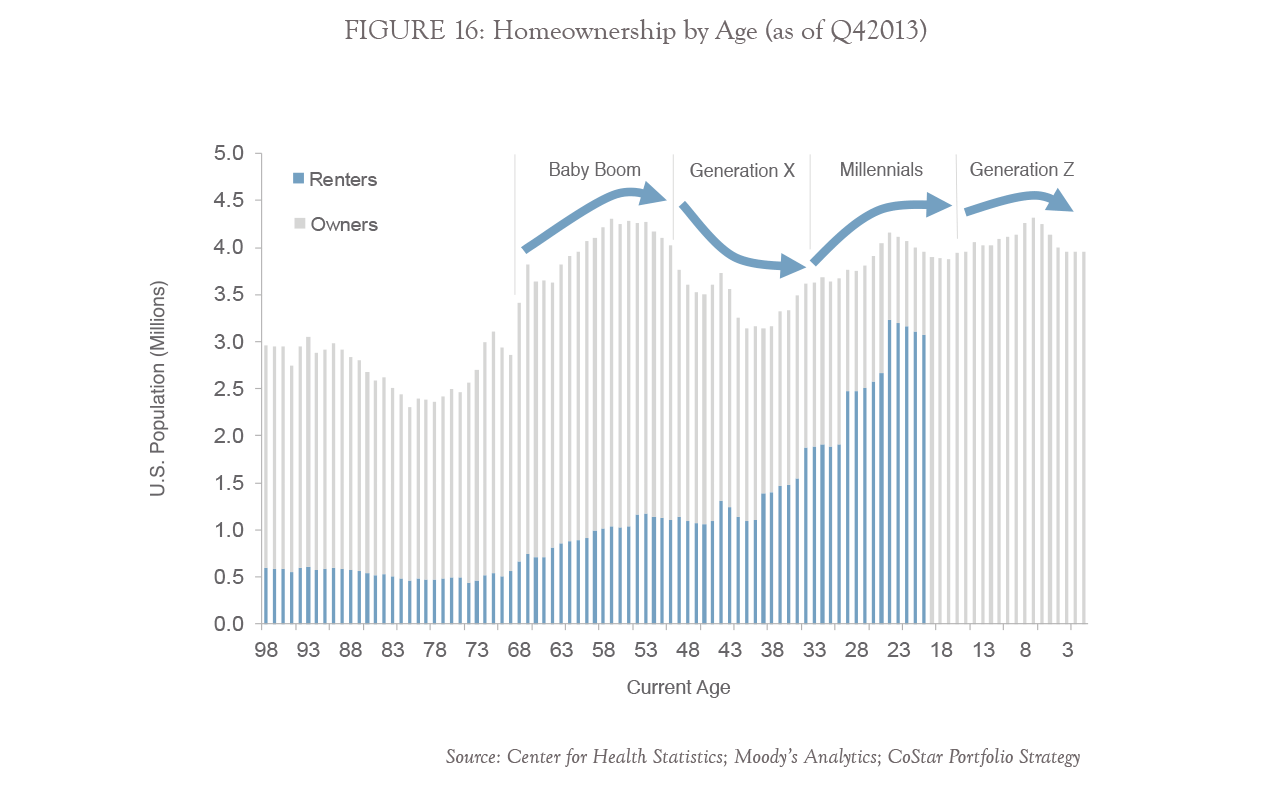

As you can see, the demand for rental units is massive. The above three groups are large enough to positively impact commercial multifamily for years and years. However, there is another trend that is driving demand. That trend is the decline in homeownership.

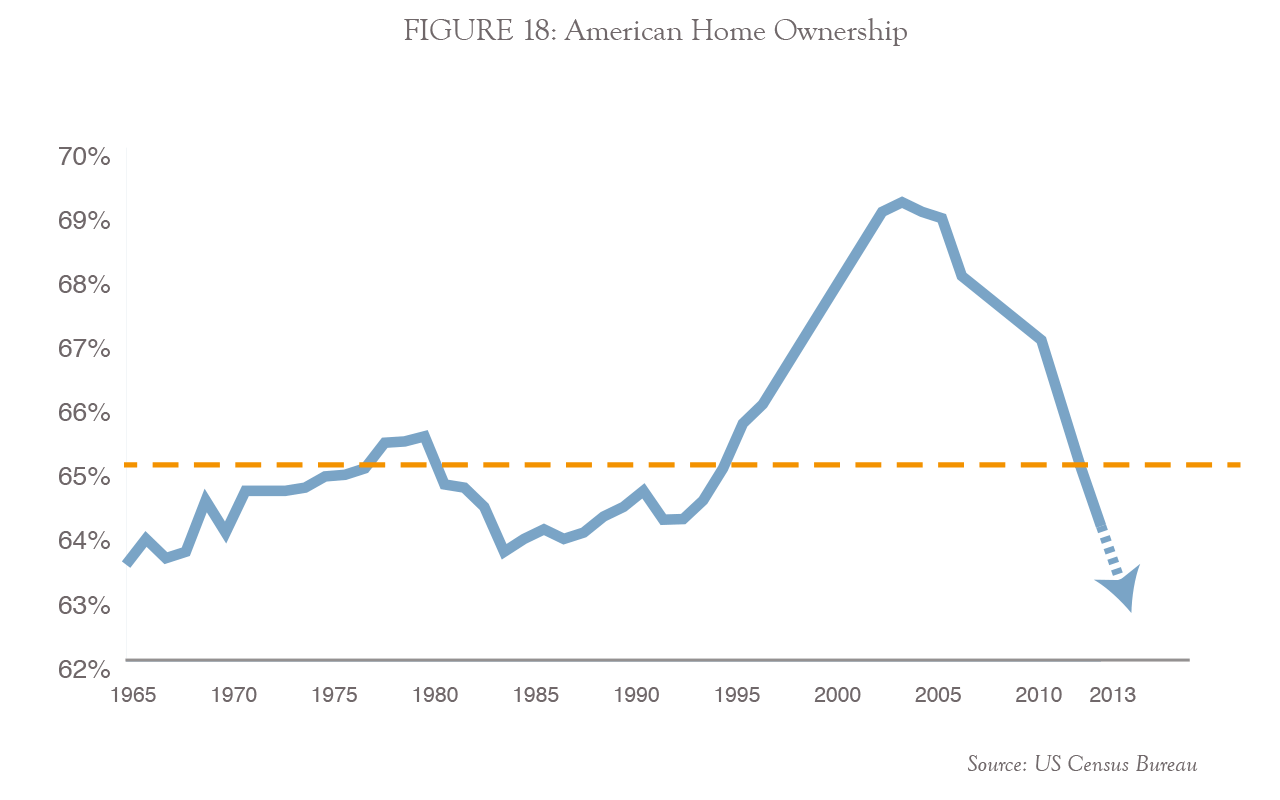

Homeownership continues to drop and every 1% drop represents 1,000,000 new renters. This trend has been sustained and is multifactorial. Tight lending markets, upside down mortgages, foreclosures, the desire for urban living and mobility have all played a part in tarnishing homeownership as the American dream. As homeownership drops, so does rental vacancy rates leading to high apartment occupancy rates.

Now that we have examined the incredible demand in the rental market, let’s look at supply.

Constrained Supply

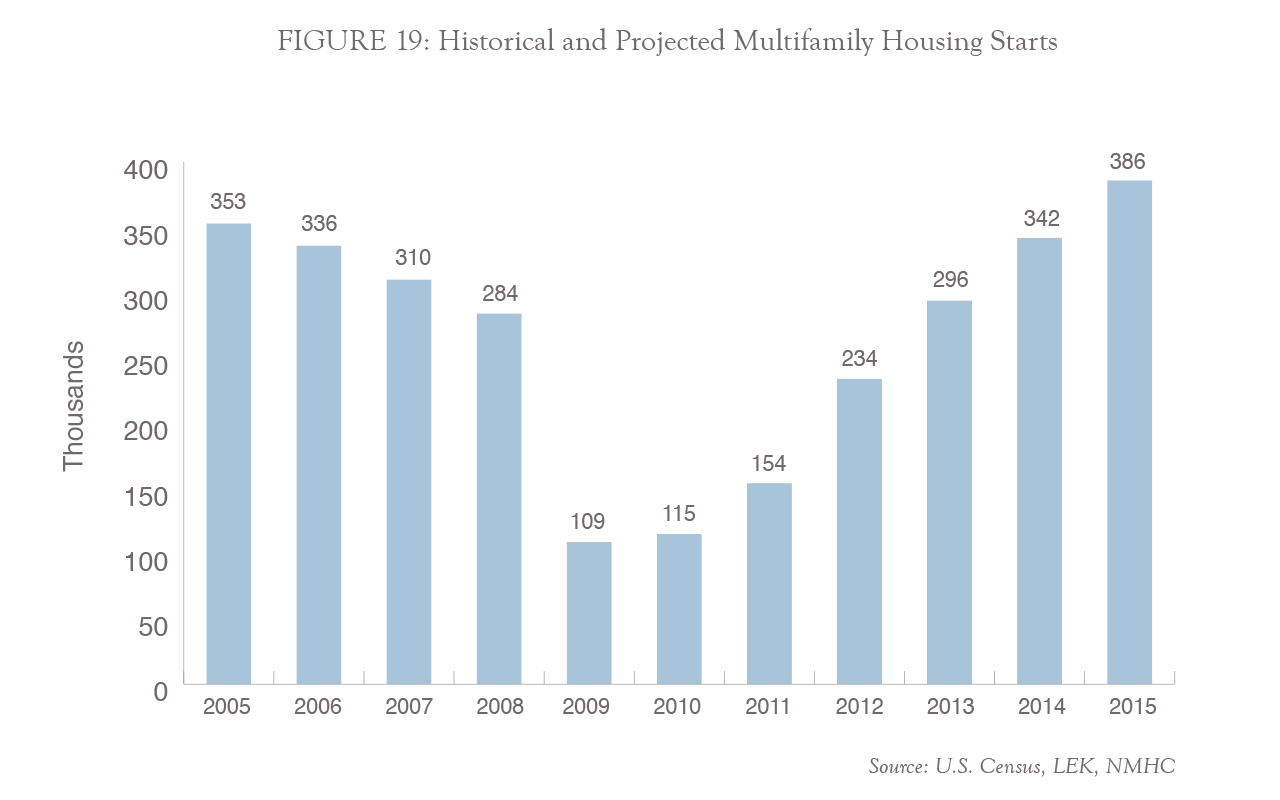

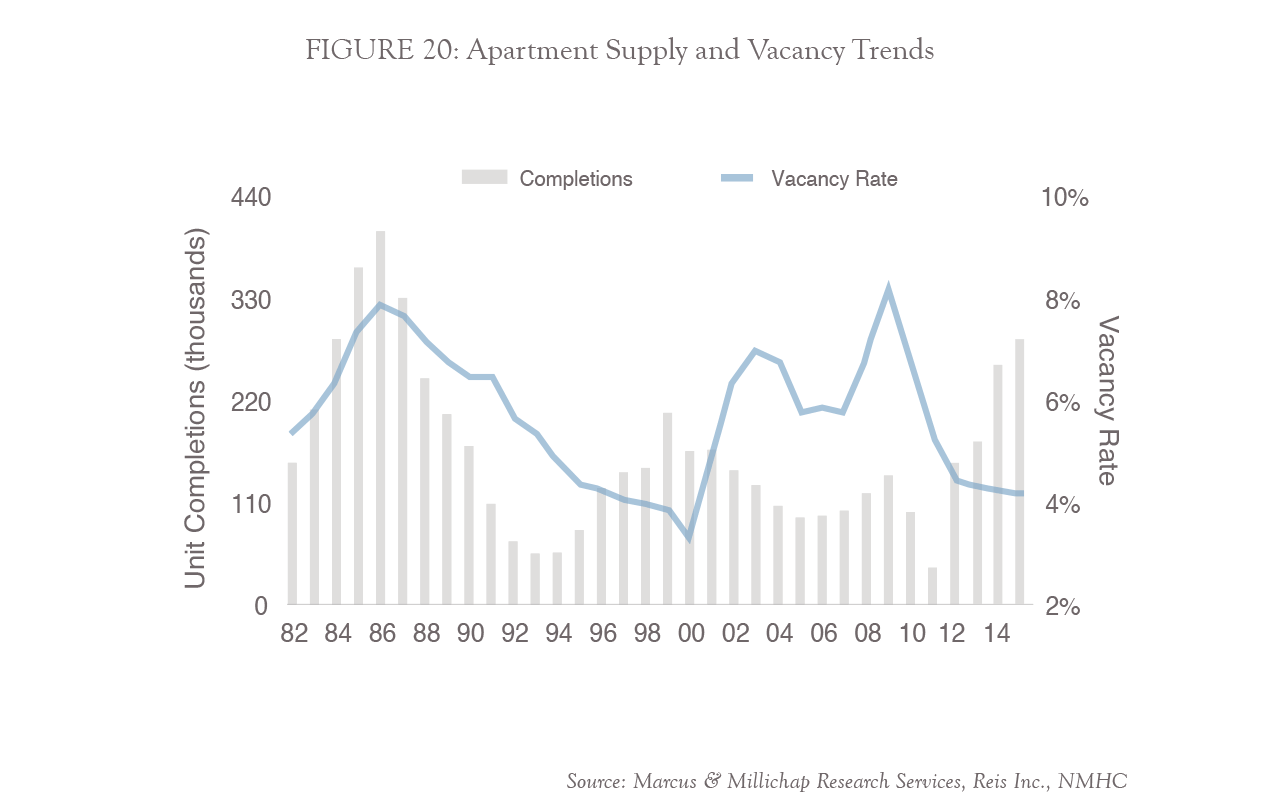

Currently there are 1,820,000 new households formed each year in the United States. From 2001 to 2014, there were less than 300,000 new apartment units put into service annually.10, 12 This supply and demand gap has been going on for years.

As you can see, the combination of unprecedented current and future demand coupled with constrained supply is making the commercial multifamily real estate investing landscape hard to beat.

Combine the unprecedented current and future demand with a constrained supply, and commercial multifamily real estate investing becomes even more appealing.

Next Steps

To learn more about how you can benefit from this asset class, schedule a 15-minute phone consultation today.

Don’t hesitate as the consultation is complimentary and there is No Cost and No Obligation to you. We welcome the opportunity to assist you in reaching your financial goals.

References & Sources

- WikiBooks. Real Estate Financing and Investing/Sources of Funds.

https://en.wikibooks.org/wiki/Real_Estate_Financing_and_Investing/Sources_of_Funds - J.P. Morgan Asset Management. Real Estate: Alternative No More. July 2012.

https://am.jpmorgan.com/blobcontent/131/169/1383169203231_11_559.pdf - The Street. Real Estate: Best-Performing Asset Class During the Past 20 Years. October 2016.

https://www.thestreet.com/story/13861401/1/real-estate-best-performing-asset-class-during-the-past-20-years.html - MetLife Investment Management. US Core Real Estate: A Past, Present, and Future View. 2017.

https://www.metlife.com/assets/cao/investments/US-Core-Real-Estate-Par-Present-Future-View.pdf - Mortgage Bankers Association. Commercial/Multifamily Mortgage Delinquency Rates for Major Investor Groups. Q2 2016.

https://www.mba.org/Documents/Research/2Q16CMFDelinquency.pdf - Forbes. Five Reasons 8 Out Of 10 Businesses Fail. September 2013.

http://www.forbes.com/sites/ericwagner/2013/09/12/five-reasons-8-out-of-10-businesses-fail/#605955d55e3c - Inc. Why 96 Percent of Businesses Fail Within 10 Years. August 2015.

http://www.inc.com/bill-carmody/why-96-of-businesses-fail-within-10-years.html - Business Insider. Millennials Are Getting Stuck Renting For Way Longer Than Previous Generations. August 2015.

http://www.businessinsider.com/millennials-renting-for-very-long-time-2015-8 - CNBC. Millennials will be renting for a lot longer. September 2016.

http://www.cnbc.com/2016/09/09/millennials-will-be-renting-for-a-lot-longer.html - National Multifamily Housing Council. Apartment Supply Shortage Fact Sheet.

https://www.nmhc.org/Advocacy/Apartment-Supply-Shortage-Fact-Sheet/ - Bloomberg. Student Debt Is Stifling Home Sales. February 2012.

https://www.bloomberg.com/news/articles/2012-02-23/student-debt-is-stifling-home-sales - Freddie Mac. Multifamily Research Perspectives. 2015 Multifamily Outlook Executive Summary.

http://www.freddiemac.com/multifamily/pdf/2015_outlook.pdf